How Much Does It Cost To Transfer A Deed In Pa . As previously stated, the deed transfer cost is customarily split between the buyer and. Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Web what fees are involved in transferring a property deed? Your real estate attorney can advise you on. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Web who pays the deed transfer tax in pa? So, for a house worth $270,780 — the median home. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Fees may include recording fees or transfer taxes. Web how much does a deed transfer cost in pennsylvania? The cost of transferring a deed in pennsylvania depends on.

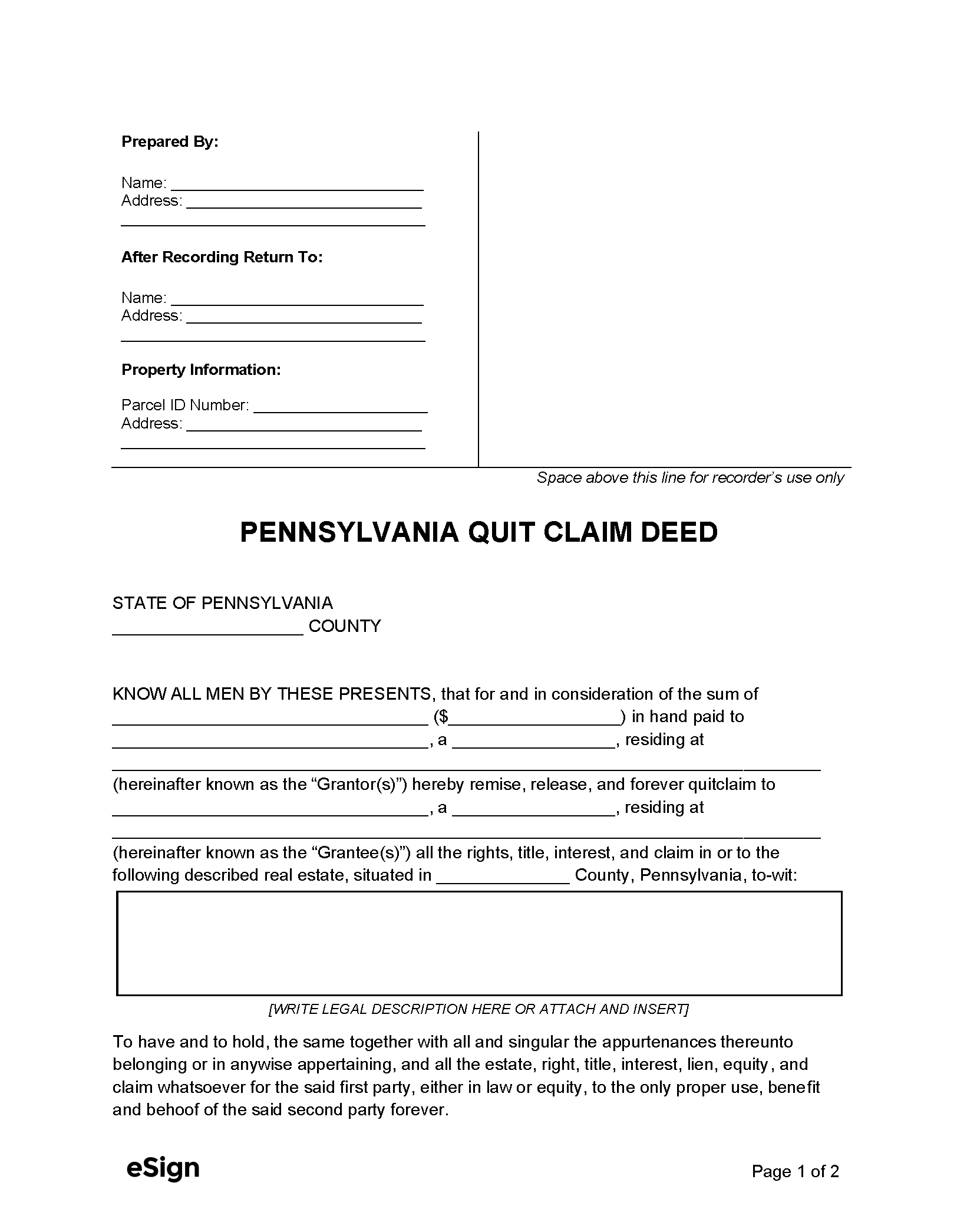

from esign.com

Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Fees may include recording fees or transfer taxes. Web what fees are involved in transferring a property deed? The cost of transferring a deed in pennsylvania depends on. Web who pays the deed transfer tax in pa? So, for a house worth $270,780 — the median home. Web how much does a deed transfer cost in pennsylvania? Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. As previously stated, the deed transfer cost is customarily split between the buyer and. Your real estate attorney can advise you on.

Free Pennsylvania Deed Forms

How Much Does It Cost To Transfer A Deed In Pa The cost of transferring a deed in pennsylvania depends on. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Your real estate attorney can advise you on. Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Web who pays the deed transfer tax in pa? Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web how much does a deed transfer cost in pennsylvania? The cost of transferring a deed in pennsylvania depends on. As previously stated, the deed transfer cost is customarily split between the buyer and. Fees may include recording fees or transfer taxes. Web what fees are involved in transferring a property deed? So, for a house worth $270,780 — the median home.

From www.signnow.com

Pa Deed Trust Form Fill Out and Sign Printable PDF Template airSlate SignNow How Much Does It Cost To Transfer A Deed In Pa Web who pays the deed transfer tax in pa? The cost of transferring a deed in pennsylvania depends on. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web what fees are involved in transferring a property deed? Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's.. How Much Does It Cost To Transfer A Deed In Pa.

From mightypricey.com

How Much Does It Cost to Transfer Property Deeds Understanding the Costs and Taxes Involved How Much Does It Cost To Transfer A Deed In Pa Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. So, for a house worth $270,780 — the median home. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. As previously stated,. How Much Does It Cost To Transfer A Deed In Pa.

From templates.legal

Pennsylvania Deed Forms & Templates (Free) [Word, PDF, ODT] How Much Does It Cost To Transfer A Deed In Pa Fees may include recording fees or transfer taxes. Web how much does a deed transfer cost in pennsylvania? Web who pays the deed transfer tax in pa? Your real estate attorney can advise you on. The cost of transferring a deed in pennsylvania depends on. As previously stated, the deed transfer cost is customarily split between the buyer and. Web. How Much Does It Cost To Transfer A Deed In Pa.

From www.sampleforms.com

FREE 7+ Deed Transfer Forms in PDF Ms Word How Much Does It Cost To Transfer A Deed In Pa Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Your real estate attorney can advise you on. Web how much does a deed transfer cost in pennsylvania? The cost of transferring a deed in pennsylvania depends on. Fees may include recording fees or transfer taxes. As previously stated, the deed transfer cost is customarily split between the buyer. How Much Does It Cost To Transfer A Deed In Pa.

From www.pedersonrealestatelaw.com

Know your closing terms What's the difference between a title and a deed How Much Does It Cost To Transfer A Deed In Pa Web pennsylvania's current transfer tax rate is usually $2.00 per $100. So, for a house worth $270,780 — the median home. Web how much does a deed transfer cost in pennsylvania? Fees may include recording fees or transfer taxes. As previously stated, the deed transfer cost is customarily split between the buyer and. Your real estate attorney can advise you. How Much Does It Cost To Transfer A Deed In Pa.

From www.thebalancemoney.com

How to Use a TransferonDeath Deed to Avoid Probate How Much Does It Cost To Transfer A Deed In Pa The cost of transferring a deed in pennsylvania depends on. Web who pays the deed transfer tax in pa? Web what fees are involved in transferring a property deed? Web pennsylvania's current transfer tax rate is usually $2.00 per $100. As previously stated, the deed transfer cost is customarily split between the buyer and. So, for a house worth $270,780. How Much Does It Cost To Transfer A Deed In Pa.

From www.youtube.com

How much cost to transfer HOUSE & LOT? deed of sale and deed of donation YouTube How Much Does It Cost To Transfer A Deed In Pa Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Fees may include recording fees or transfer taxes. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Web who pays the deed transfer tax in pa? Web how much does a deed transfer. How Much Does It Cost To Transfer A Deed In Pa.

From pearllemonproperties.com

How Much Does It Cost To Transfer Property Deeds? Pearl Lemon Properties How Much Does It Cost To Transfer A Deed In Pa The cost of transferring a deed in pennsylvania depends on. Web who pays the deed transfer tax in pa? Fees may include recording fees or transfer taxes. Web how much does a deed transfer cost in pennsylvania? Web what fees are involved in transferring a property deed? Your real estate attorney can advise you on. As previously stated, the deed. How Much Does It Cost To Transfer A Deed In Pa.

From pearllemonproperties.com

How Much Does It Cost To Transfer Property Deeds? Pearl Lemon Properties How Much Does It Cost To Transfer A Deed In Pa Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Web how much does a deed transfer cost in pennsylvania? Your real estate. How Much Does It Cost To Transfer A Deed In Pa.

From carolpaige.pages.dev

Franklin County Pa Deed Transfers 2025 Free Carol Paige How Much Does It Cost To Transfer A Deed In Pa Fees may include recording fees or transfer taxes. Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. As previously stated, the deed transfer cost is customarily split between the buyer and. The cost of transferring a deed in pennsylvania depends on. Web who pays the deed transfer tax in pa? Your real estate. How Much Does It Cost To Transfer A Deed In Pa.

From kaylynwmarne.pages.dev

Centre County Deed Transfers 2024 Pennsylvania Abby Jessica How Much Does It Cost To Transfer A Deed In Pa Web what fees are involved in transferring a property deed? So, for a house worth $270,780 — the median home. Your real estate attorney can advise you on. Fees may include recording fees or transfer taxes. The cost of transferring a deed in pennsylvania depends on. Web to transfer real estate in pennsylvania, a property deed must be filled out. How Much Does It Cost To Transfer A Deed In Pa.

From www.nationalpropertybuyers.co.uk

What is a Title Deed? National Property Buyers How Much Does It Cost To Transfer A Deed In Pa Web what fees are involved in transferring a property deed? Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. As previously stated, the deed transfer cost is customarily split between the buyer and. Web how much does a. How Much Does It Cost To Transfer A Deed In Pa.

From www.solicitorsnearmeuk.co.uk

How Much Does A Deed Of Variation Cost How Much Does It Cost To Transfer A Deed In Pa So, for a house worth $270,780 — the median home. As previously stated, the deed transfer cost is customarily split between the buyer and. The cost of transferring a deed in pennsylvania depends on. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web what fees are involved in transferring a property deed? Your real estate attorney can. How Much Does It Cost To Transfer A Deed In Pa.

From www.statecollege.com

Deed Transfers State College, PA How Much Does It Cost To Transfer A Deed In Pa Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Web what fees are involved in transferring a property deed? Fees may include recording fees or transfer taxes. So, for a house worth $270,780 — the median home. Web how much does a deed transfer cost in pennsylvania? Web to transfer real estate in. How Much Does It Cost To Transfer A Deed In Pa.

From eforms.com

Pennsylvania Deed Forms eForms How Much Does It Cost To Transfer A Deed In Pa Fees may include recording fees or transfer taxes. Web who pays the deed transfer tax in pa? As previously stated, the deed transfer cost is customarily split between the buyer and. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. The cost of transferring a deed in pennsylvania depends on. Web how much does a deed transfer cost. How Much Does It Cost To Transfer A Deed In Pa.

From carolpaige.pages.dev

Franklin County Pa Deed Transfers 2025 Free Carol Paige How Much Does It Cost To Transfer A Deed In Pa Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Web who pays the deed transfer tax in pa? Web information about pennsylvania deed law, including quitclaim deed form, special warranty deed form, and general. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Fees may include recording. How Much Does It Cost To Transfer A Deed In Pa.

From www.uslegalforms.com

Pennsylvania Warranty Deed from Corporation to Individual What Does A Deed Look Like US How Much Does It Cost To Transfer A Deed In Pa The cost of transferring a deed in pennsylvania depends on. Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. Your real estate attorney can advise you on. Web pennsylvania's current transfer tax rate is usually $2.00 per $100. Web how much does a deed transfer cost in pennsylvania? Fees. How Much Does It Cost To Transfer A Deed In Pa.

From templates.legal

Pennsylvania Deed Forms & Templates (Free) [Word, PDF, ODT] How Much Does It Cost To Transfer A Deed In Pa Web who pays the deed transfer tax in pa? So, for a house worth $270,780 — the median home. Web to transfer real estate in pennsylvania, a property deed must be filled out and recorded in the county recorder's. The cost of transferring a deed in pennsylvania depends on. Web pennsylvania's current transfer tax rate is usually $2.00 per $100.. How Much Does It Cost To Transfer A Deed In Pa.